The issue of GDR is governed by international laws.Two-way fungibility is permitted in GDRs whereby they are freely convertible into Shares and back into GDRs without restriction to the extent of the original issue size.ADR or GDR holders do not have voting rights and therefore not bound by strict definition of foreign ownership.The GDR does not appear in the books of the issuing company.The equity shares registered in the name of depository are then issued in form of GDR to the investors of that foreign country.Intermediary called ‘custodian’ who acts as depositor’s agent.The shares issued to the depository may be in physical possession of another.Each receipt has a fixed number of shares usually 2 or 4.The Depository issues a receipt against these shares.All shares to be issued are deposited with an intermediary called ‘depository’ located in the listing country.And funds are raised from foreign capital market of the USA and Europe.GDRs are traded on stock exchanges of Europe and USA.The issuer collects the proceeds in foreign currency.GDR represents certain number of equity shares denominated in dollar terms.For example, a GDR of $100 may comprise of 2 equity shares of $50 each amounting to whatever the prevailing exchange rate is. GDR equity shares are denominated in dollar and tradable on a stock exchange in Europe or USA. It’s just that the name differs but the features are identical for these equities confirming norms and rules pertaining to respective countries where these are issued and listed. American Depository Receipts (ADR)- #Popular.These shares are then listed on American and European stock exchanges by complying to their regulations. To understand the concept of FCCBs/ADRs/GDRs lets first understand the Euro equity issue first.Įuro equity represents shares that are denominated in dollars and are issued by either non-American or non-European companies. These Depository Receipts may be traded freely on an exchange or an over-the-counter market.ĭepository Receipts can be either “GDRs” which are usually listed on a European stock exchange, or American Depository Receipts (“ADRs”), listed on the US stock exchange.

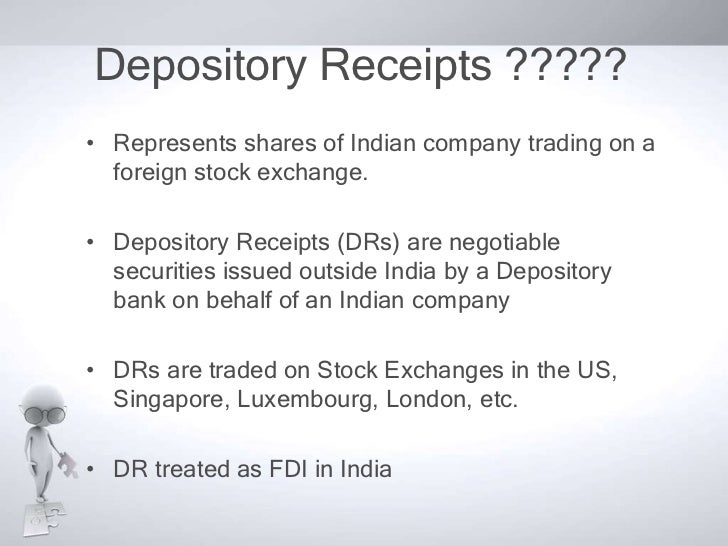

Whereby an Issuer or a non-U.S Indian company tap the global equity market to raise foreign fund thru it’s public listing and trading it in local currency equity shares in form of “Depository Receipts” Period of holding of the shares so received on conversion shall be from the date on which GDR was acquired.Depository Receipts are – Basically negotiable instruments denominated in U.S. Period of holding of the shares so received on conversion shall be from the date on which request for this redemption is made. Period of Holding of Shares so converted. Sale Consideration for calculation of Capital Gain shall be the Fair Market Value (FMV) as on the date on which REQUEST for redemption is made shall be treated as sale consideration.Īs per Section 49(2ABB), the Cost of Acquisition of shares in case it is converted from GDR shall be the price of the share prevailing on the Recognized Stock Exchange as on the date on which a request for redemption was made.ĭate on which a request for redemption was made is the date on which instruction from foreign depositary is received by local custodian.Ĭost of Acquisition of these shares shall be the cost at which GDR had been acquired by the investor. When GDRs of listed company is transferred outside India by a Non Resident to Another Non Resident it is exempt from Capital Gain Tax.Ĭapital Gain on Conversion of GDRs into Shares and Subsequent transfer of shares.Ĭonversion of GDRs into shares is treated as transfer under the Income Tax Act, 1961and such transfer is not exempt under section 47 of Income Tax Act, 1961or any other section. Further, we will see that the tax benefit available in case of GDRs is only on GDRs issued by listed companies. GDR may be issued by both listed as well as unlisted companies. Foreign Currency Convertible Bonds of issuing company.Ordinary shares of Issuing Company (Listed Company).

/multicurrency-background-of-us-dollars--russian-rubles--belarusian-rubles--egyptian-pounds-and-ukrainian-hryvnias-1138544748-8de6fd3e8b5e40caad15839f633f86a2.jpg)

The underlying security against the issue of GDR may be: Global Depository Receipt (GDR) is a foreign currency denominated financial instrument issued outside India by a foreign depository to investors, against an underlying Indian security which is deposited with a domestic custodian in India. Global Depository Receipts (GDRs) – Taxation

0 kommentar(er)

0 kommentar(er)